Order Report - Pain Points & Actions: Insights to Address Large Advice Gaps by Reaching Consumers With Unmet Needs - a Quantitative Report

TO ORDER PRINT

OR CALL NOW 800-930-0966 x1

Report Overview

The Pain Points & Actions: Insights to Address Large Advice Gaps by Reaching Consumers With Unmet Needs report reveals the most pressing pain points different groups of consumers face, the reasons they seek help, and the actions they have taken and plan to take.

Written by subject matter experts with operating experience in retail finance, consumer packaged goods and technology development, the ideas and analysis of this insight module are drawn from the latest fielding of the Hearts & Wallets Investor Quantitative™ Database (IQ™ Database), recognized as the largest single dataset on U.S. retail consumer attitudes, behaviors and buying patterns, with over 46,000 U.S. households.

Select Key Findings

-

The vast majority of consumers who find a task difficult don’t seek help, creating large advice gaps.

-

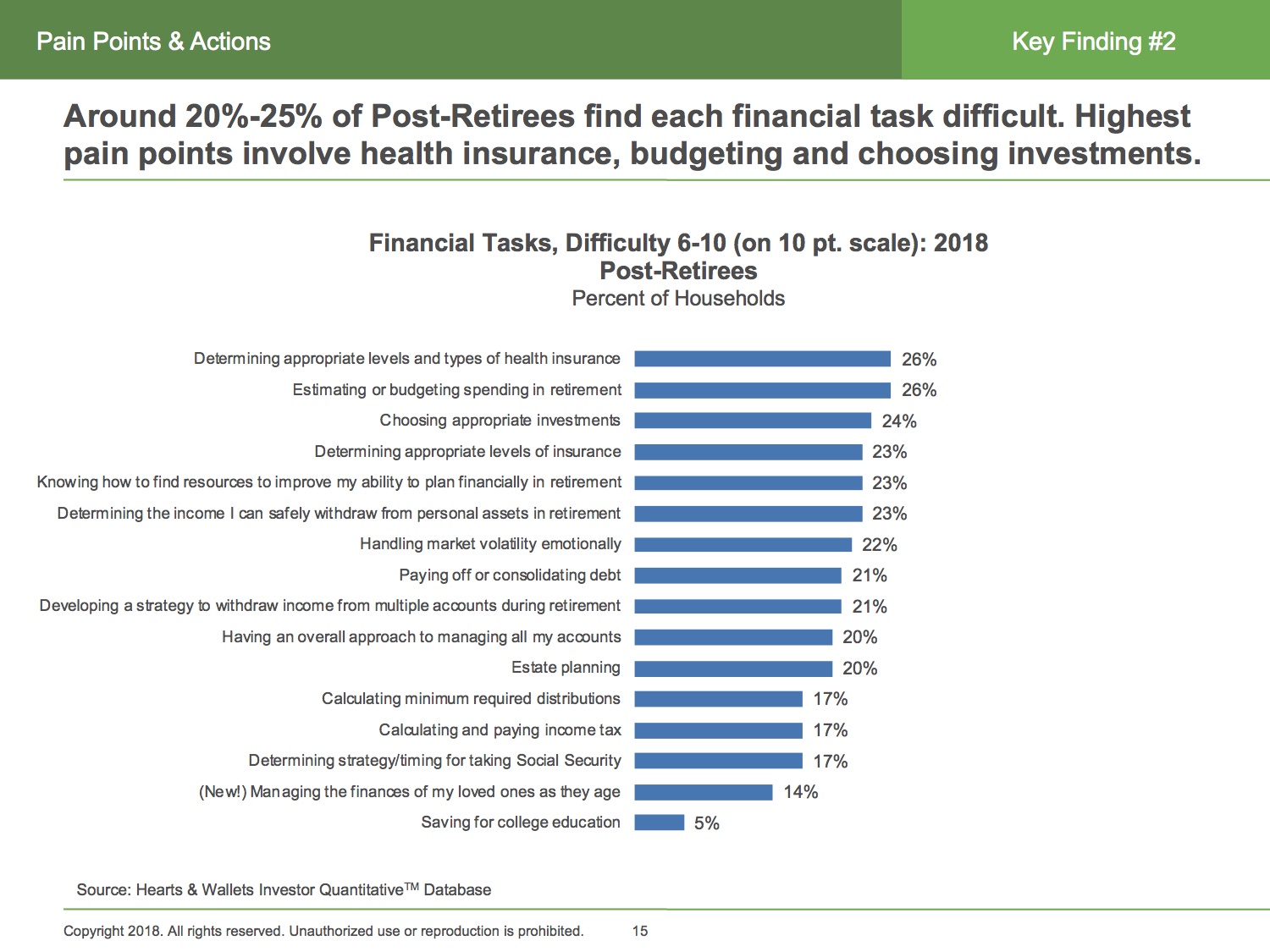

“Choosing appropriate investments” is a top pain point for all consumers. Among the many tasks that consumers say are difficult is “managing the finances of my loved ones as they age.”

-

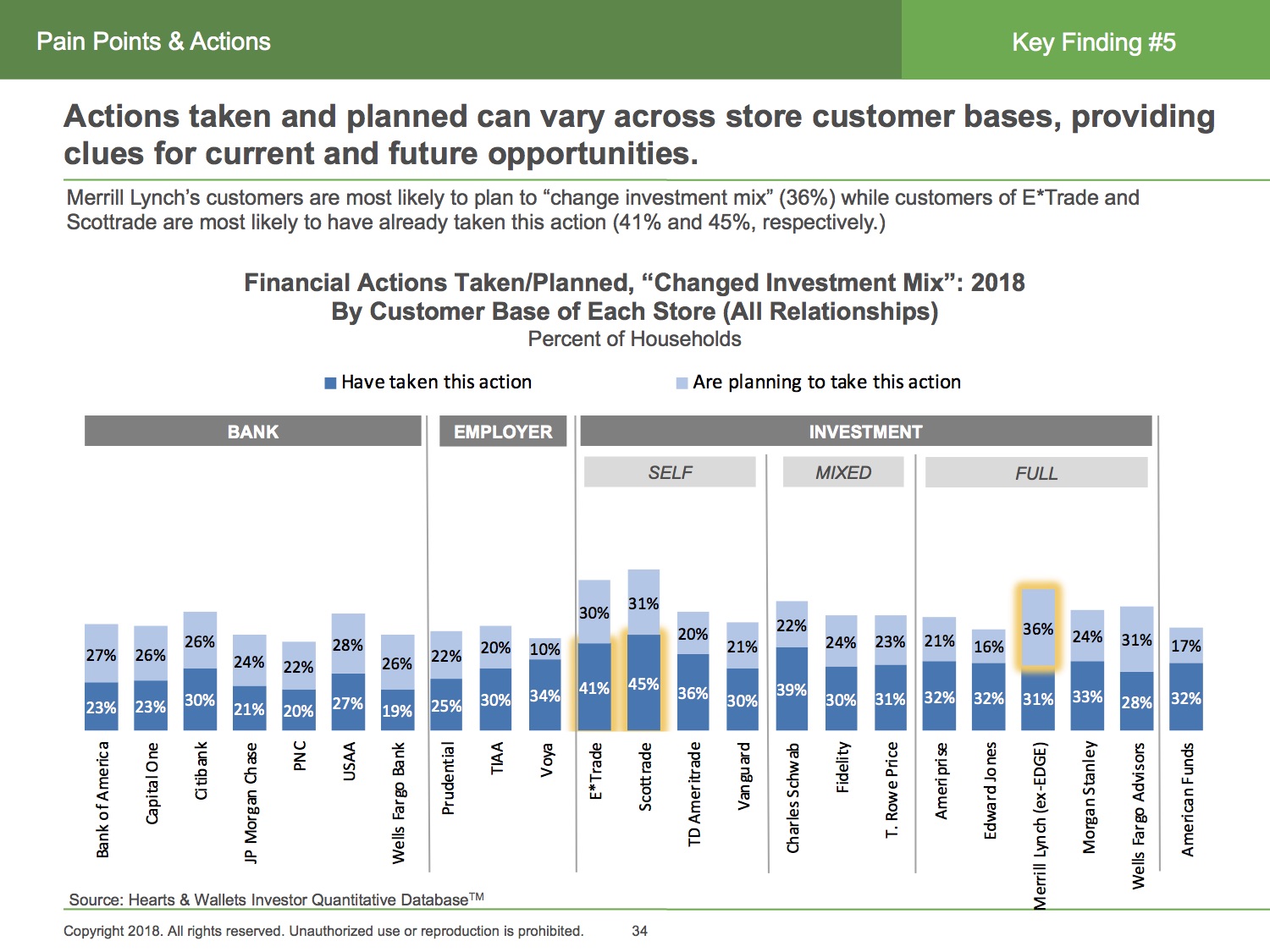

Customers of Merrill Lynch (36%) are most likely to plan to "change investment mix" (36%) while customers of E*Trade (41%) and Scottrade (45%) are most likely to have already taken this action.

How This Report Helps

Marketing, product and advice/digital design professionals will benefit from the actionable data and insights in this report to:

-

Gain insight into consumer confusion and inertia to tailor campaigns and products to address advice gaps for unmet consumer needs in areas like retirement planning.

-

Develop actionable strategies based on the tasks consumers find difficult, going beyond top pain points to uncover opportunities for differentiation.

-

Use growing consumer engagement with financial tasks to shape product development and messaging.

-

Inspire younger consumers with new programs that provide access to help to the large number of households within this group that plan to take action.

-

Reap the benefits of the competitive insights into the buying patterns at your firm, competitors and distributors to develop products and enhance loyalty.

About the Hearts & Wallets Investor Quantitative™ Database

The Hearts & Wallets Investor Quantitative™ Database (IQDB) is the comprehensive resource for understanding and analyzing behaviors and attitudes of retail savers and investors. With over 1,000 fields and derived variables, the breadth and depth of topics covered is designed with decades of hands-on experience in the marketing, product, service and research functions it serves. The database covers consumers of all age and wealth segments, with over 5,000 annual responses to an online survey fielded mid-year since 2010. The large sample size of over 46,000 U.S. households permits sizing and profiling of virtually any demographic, behavioral or attitudinal definition for consumer groups. Its national weighting methodology allows for comparisons across years and customer/shareholder bases of leading firms.

Published October 16, 2018. This 40-page report features 27 data-intensive exhibits.

Table of Contents/Directory of Exhibits and Index of Companies

Executive Summary

Key Findings & Implications Favorite Statistics, Related Research

Financial Tasks More Relevant to More Consumers

Financial Tasks, Applicable vs. Not Applicable: Pre-/Post-Retirees

Financial Tasks, Applicable vs. Not Applicable: Accumulators

Top Pain Point “Choosing Appropriate Investments”

Selected Financial Tasks, Difficulty 6-10: by Lifestage

Financial Tasks, Difficulty 6-10: Post-Retirees, Pre-Retirees, Accumulators

Selected Financial Tasks, Difficulty 6-10: by Accumulator Lifestages

Low Rates Seeking Help Creating Large Advice Gaps

Seeking Help on Selected Financial Tasks: by Lifestage

Seeking Help on Financial Tasks: Post-Retirees, Pre-Retirees, Accumulators

Early Career Analysis: Difficulty, Seeking Help, Advice Gaps

More Younger Consumers Plan to Take Action vs. Older Consumers

Financial Actions Taken/Planned: Pre-/Post-Retirees, Accumulators

Financial Actions Planned: Accumulators vs. Pre-/Post-Retirees

Financial Actions Planned: by Accumulator Lifestages

Financial Actions Planned, Sized in Households (M) and Total Investable Assets ($T)

Actions Planned Vary Based on Customers of Each Store

Financial Actions Taken/Planned: by Store Customer Bases

Top 5 Actions Planned: by Customer Bases of TIAA, Fidelity and Ameriprise

Appendix

Appendix: Terminology & Definition, Sample Sizes

Index of Companies

American Funds

Ameriprise

Bank of America/Merrill Lynch

Capital One

Citibank

Charles Schwab

Edward Jones

E*Trade

Fidelity Investments

JP Morgan Chase

Morgan Stanley

PNC

Scottrade

TIAA

T. Rowe Price

USAA

Vanguard

VOYA

Wells Fargo

Get the Pain Points & Actions Report! Contact us for pricing options to order.

Select the desired report(s) and send a signed copy of this form to info@heartsandwallets.com or fax to 800-930-0966. We will prepare a separate invoice for payment.

By signing this form, I certify that I am authorized to make this purchase on behalf of my company (“Customer”) and that Customer agrees to the following terms. Hearts & Wallets grants Customer a limited, non-exclusive, non-assignable license to use the Hearts & Wallets’ report for Customer’s private, internal use only. Customer shall not use any portion of the report for external use. Customer shall not share the report with any third-party, shall not permit other persons to use the report, shall not create derivative works based upon the report, and shall not sell, lease, or otherwise transfer rights to the report. Any such forbidden use shall immediately terminate Customer’s license to the report. All title, ownership, rights, and intellectual property rights in the report shall at all times remain vested in Hearts & Wallets. Customer does not receive any ownership rights or intellectual property rights in the report. Upon receipt of this report, Customer accepts the report and agrees to pay the amount specified.