Order Report - Portrait™ of U.S. Household Wealth: Essential Facts for Sizing Target Markets in an Era of Growing Wealth Concentration

Report Overview

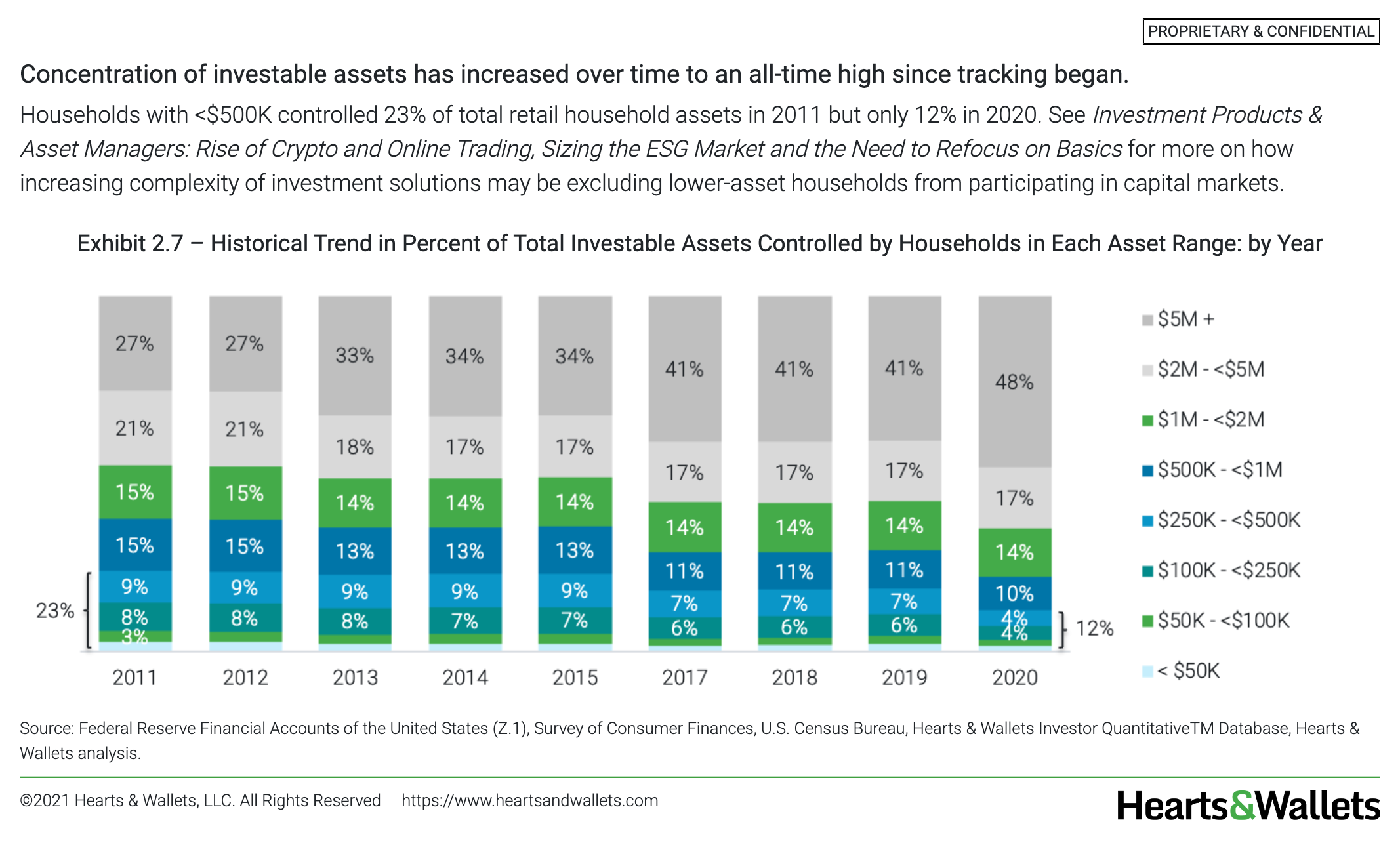

This report covers the demographic breakdown of household wealth in America. U.S retail investors control $68.3T in investable assets. This is at an all time high but there is an unprecedented concentration of wealth in higher asset households. Learn who controls the wealth by life stage and asset level through the Portrait Grid™. This research is the foundation of all market sizing at Hearts & Wallets.

Key Findings

- U.S retail investors control $68.3T, an all-time high.

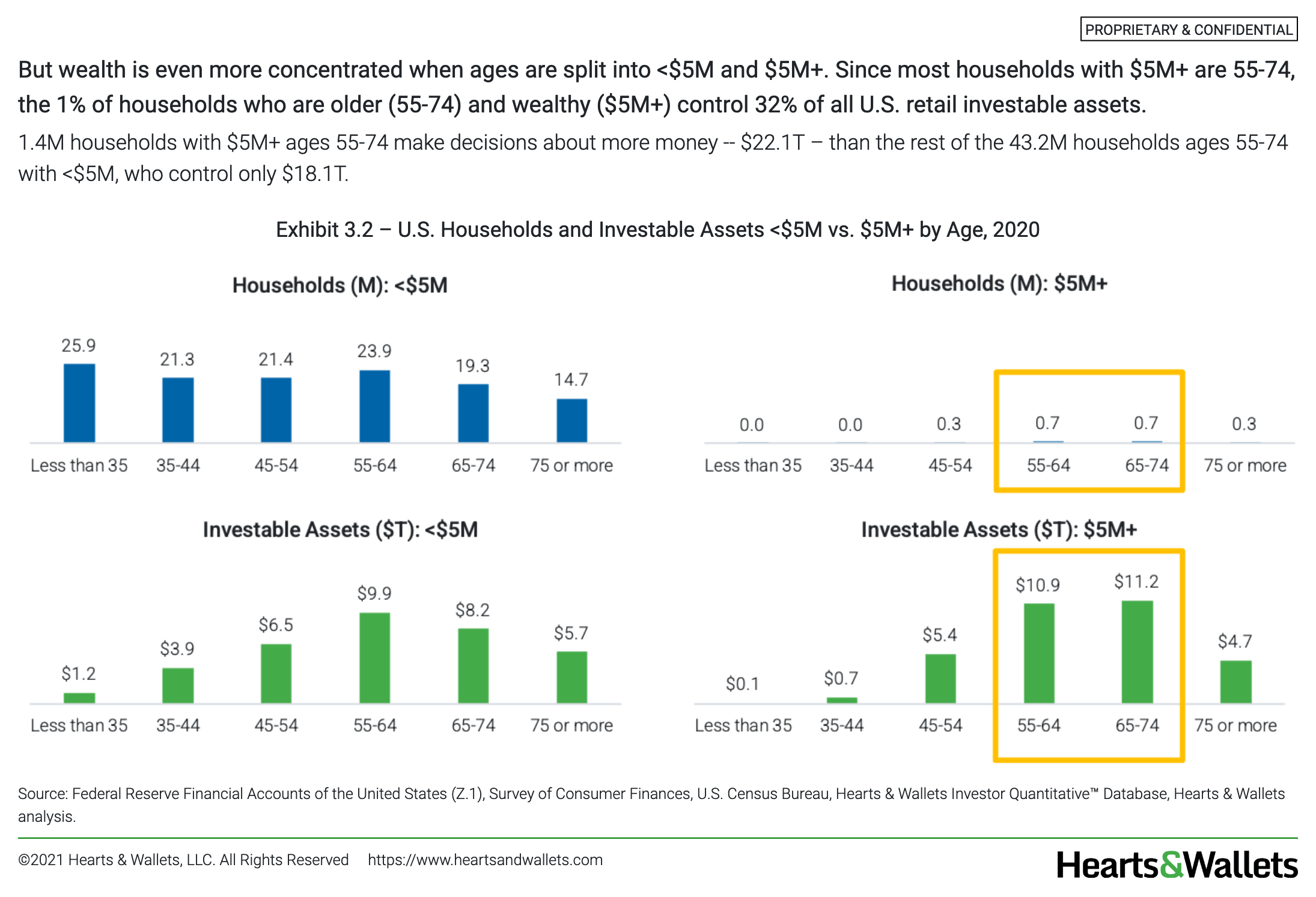

- The Portrait Grid™, which shows households and investable assets by age and asset groups, illuminates today’s unprecedented concentration of wealth

- Investable assets in ages 55-74 and Post-Retirees show high growth, but this is due to the high concentration of households with $5M+ within these demographics.

- Overlaying IQ™ Database fields onto Portrait™ market sizing quantifies innovation opportunities to facilitate strategic decision-making.

Convenient Options To Suit Your Needs and Budget

Choose access licenses for your team or organization in ways that support how you collaborate. AVAILABLE FOR LICENSE TO NON TRENDS SUBSCRIBERS JULY 15, 2021.

Online with slide download, PPT & PDF (unlimited log-ins) - $25,000

Online with slide download (1-50 logs-ins) - $18,000

Online only (1-20 log-ins) - $18,000

Sample Report Pages