Portrait™ of U.S. Household Wealth 2024: Sizing the Growth Prospects for Older Households and Categories of Advice

Order Report - Portrait™ of U.S. Household Wealth 2024: Sizing the Growth Prospects for Older Households and Categories of Advice

Report Overview

Key Findings

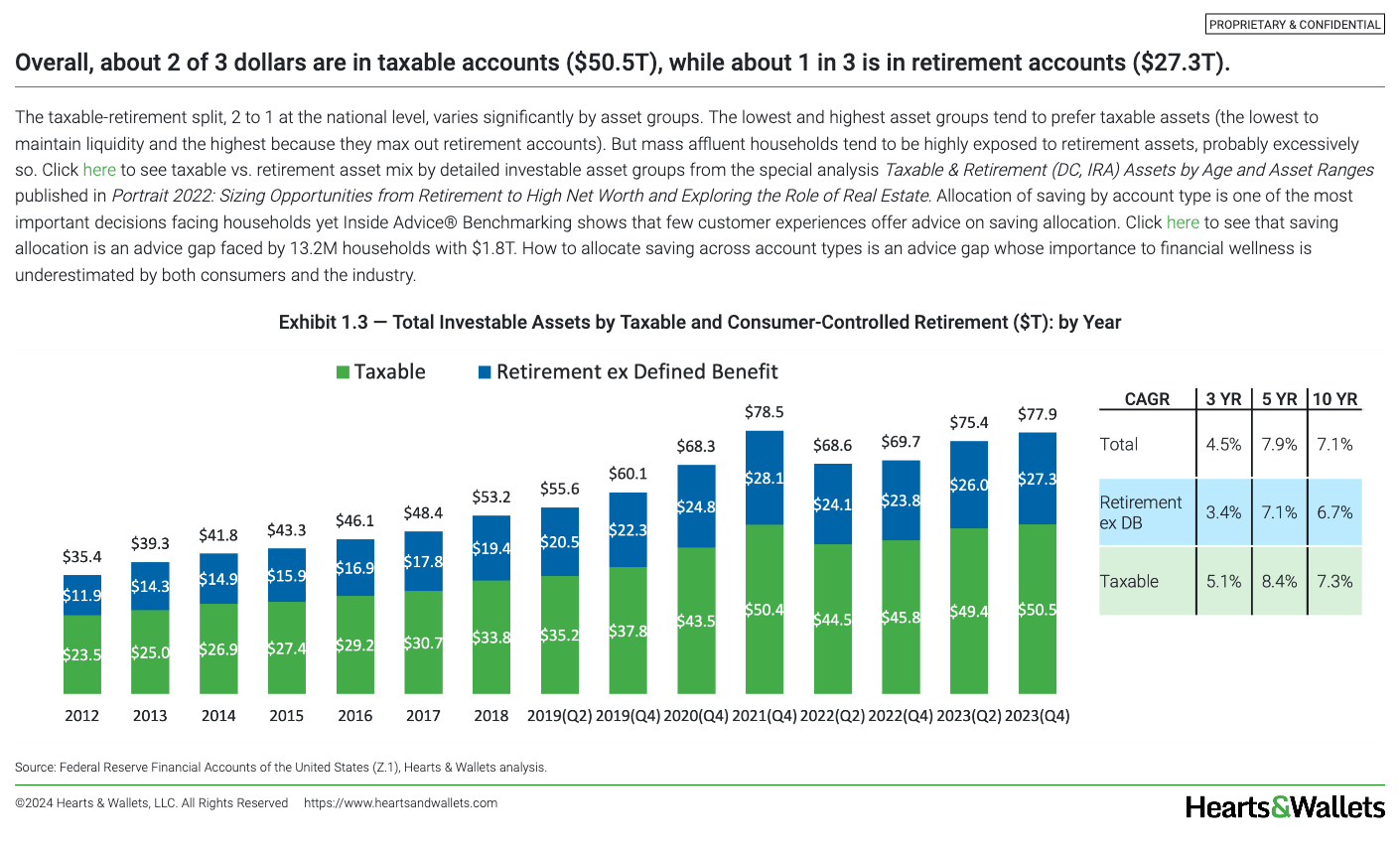

- 131M U.S. households make decisions about $78T of investable assets in the context of $137T of total wealth. Taxable and IRA assets are growing faster than defined contribution (DC), but all 3 trail the growth of net equity in real estate.

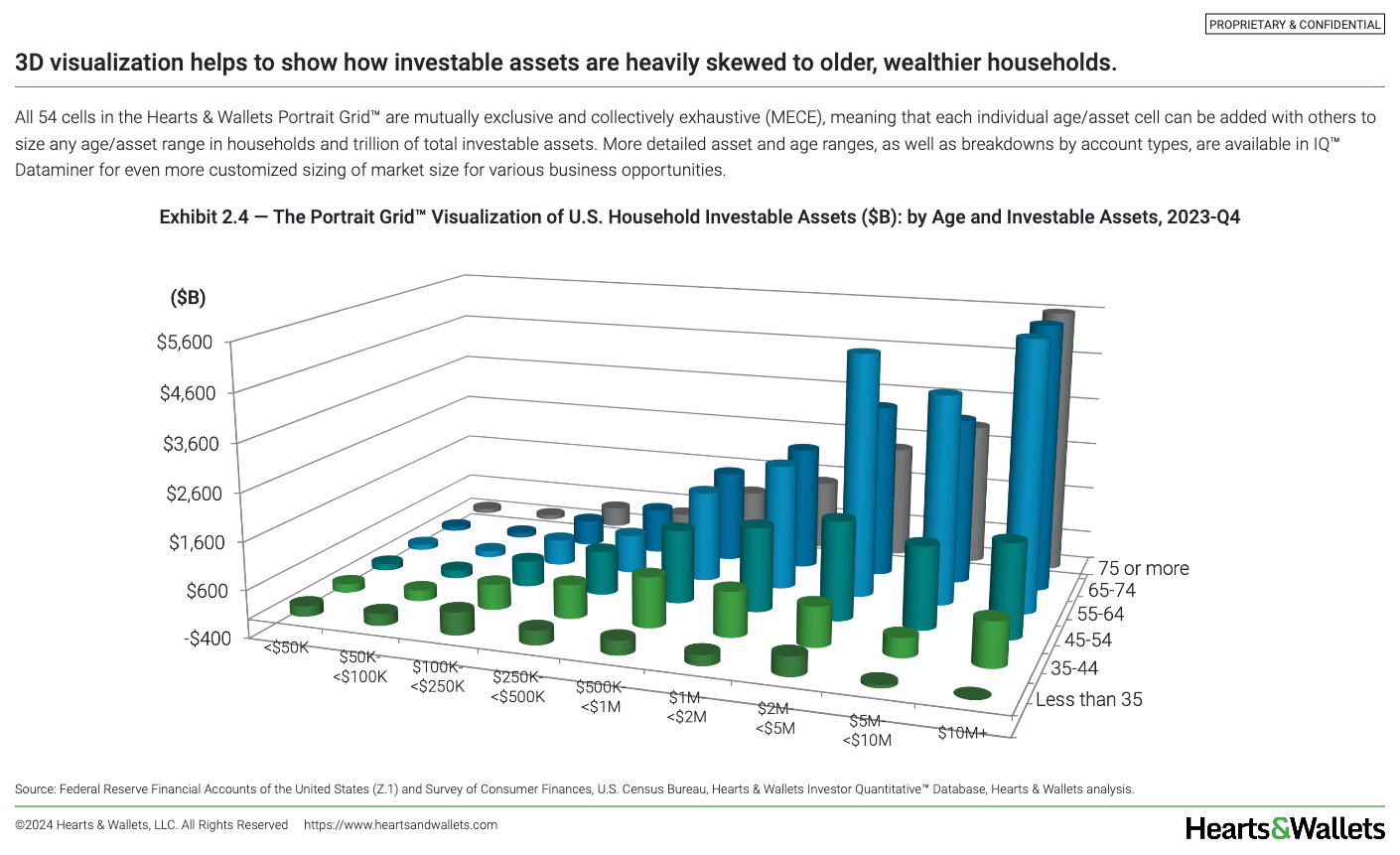

- Market sizes are very different when measured in assets or households. Assets are concentrated in relatively few, wealthier households.

- Older consumers, across a mix of generations, control more assets today than other groups and are the fastest growing.

- Only 45% of store relationships provide both advice and service. The market for advice experiences is potentially bigger than it is

Pricing

Choose access licenses for your team or organization in ways that support how you collaborate. AVAILABLE FOR LICENSE TO NON TRENDS SUBSCRIBERS NOVEMBER, 2024.

Online with slide download, PPT & PDF (unlimited log-ins) - $28,000

Online with slide download (1-50 logs-ins) - $22,000

Online only (1-20 log-ins) - $18,000

Sample Report Pages