Order Report - Attitudes & Sentiment: Consumer Beliefs to Guide Strategic Decisions and New Product Development – a Quantitative Report

Report Overview

Get the full picture on consumer goals, sentiments, concerns and attitudes toward saving and investing to guide strategy and inform decisions.

Select Key Findings

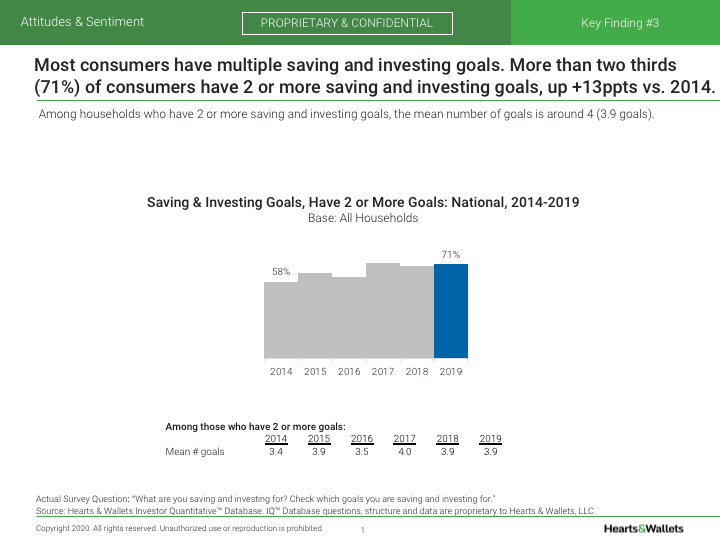

- 71% of consumers have 2 or more saving and investing goals, up 13 percentage points vs. 2014.

- The No. 1 most agreed-with attitude nationally (47%) of consumers is “I wish I were doing a better job saving.”

- Half of consumers ages 21 to 27 believe that “companies should help their employees pay off student debt.”

About the Hearts & Wallets Investor Quantitative™ Database

The Hearts & Wallets Investor Quantitative™ Database (IQDB) is the comprehensive resource for understanding and analyzing behaviors and attitudes of retail savers and investors. With an annual sampling wave that includes all age and wealth segments, the database is now composed of over 50,000 U.S. households and 1,600 fields and derived variables stretching back to 2010. The database enables sizing and profiling of virtually any demographic, behavioral or attitudinal definition for consumer groups.

This new 73-page report features 58 exhibits.

Executive Summary

Methodology

Key Findings & Implications, Favorite Statistics, Related Research

1. Nationally, fewer consumers feel “secure” about their financial future, even as perceptions of inexperience with investing are at a 5-year low.

Feelings about Financial Future, All Anxiety Levels and High Anxiety Levels: National, by Lifestage, By Investable Assets

Perception of Experience with Investing, All Experience Levels and Very/Somewhat Inexperienced : National, by Lifestage, By Investable Assets

Inexperienced : National, by Lifestage, By Investable Assets

Risk Tolerance, All Comfort Levels and Very/Somewhat Comfortable: National, by Lifestage, By Investable Assets

2. Concerns about macroeconomic issues remain lower than they were 5 years ago but are inching up.

Concern about Issues, High Concern: by National, by Accumulators, by Pre-/Post-Retirees Percentage Point Change in Concern about Issues, High Concern Select Individual Concerns, by National, by Accumulators, By Pre-/Post-Retirees

3. More households have multiple saving and investing goals; retirement goals are not as important to as many people as “emergency fund,” while investing goals have gained relevance.

Saving & Investing Goals, Have 2 or More: by National, by Investable Asset Ranges

Percentage Point Change in Saving & Investing Goals

4. Consumer reactions to top strategically important topics can guide business decisions about saving, investing and advice solutions.

Attitudes, Ranked by Levels of Agreement on 10-Point Scale: National

Select Individual Attitudes: By National, by Lifestage, by Investable Assets

5. Confirming that workplace programs need to evolve to financial wellness, more consumers believe employers should “pay off student debt” than take “responsibility for providing for my retirement.”

Select Employment and Employer Related Attitudes: By National, by Lifestage, by Investable Assets

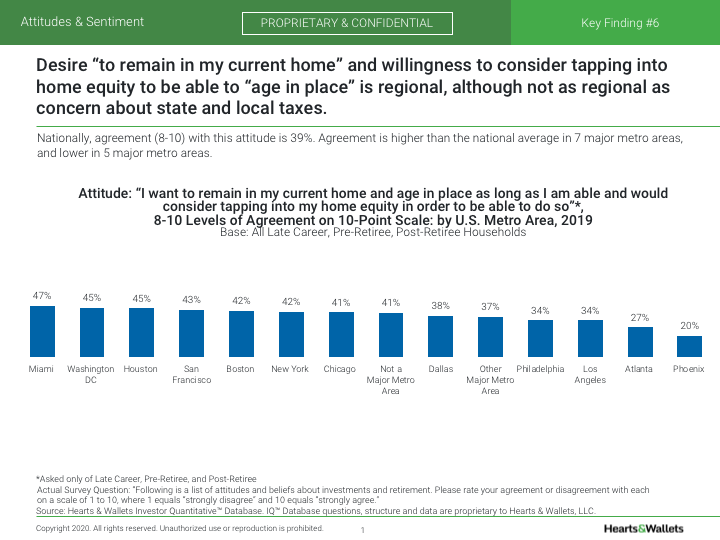

6. Consumer attitudes toward real estate indicate serious considerations for advice.

Select Real Estate Related Attitudes: By National, by Lifestage, by Investable Assets Crosstab Analysis of Select Real Estate Related Attitudes: By National

Appendix

Attitudes and Sentiment Insight Module Data Dictionary

Glossary, Sample Sizes

Get the Attitudes & Sentiment: Consumer Beliefs to Guide Strategic Decisions and New Product Development Report! Contact us for pricing options to order.

Click on the email below to request more information. Or fill out the request form at the upper right.

Select the desired report(s) and send a signed copy of this form to info@heartsandwallets.com or fax to 800-930-0966. We will prepare a separate invoice for payment.

By signing this form, I certify that I am authorized to make this purchase on behalf of my company (“Customer”) and that Customer agrees to the following terms. Hearts & Wallets grants Customer a limited, non-exclusive, non-assignable license to use the Hearts & Wallets’ report for Customer’s private, internal use only. Customer shall not use any portion of the report for external use. Customer shall not share the report with any third-party, shall not permit other persons to use the report, shall not create derivative works based upon the report, and shall not sell, lease, or otherwise transfer rights to the report. Any such forbidden use shall immediately terminate Customer’s license to the report. All title, ownership, rights, and intellectual property rights in the report shall at all times remain vested in Hearts & Wallets. Customer does not receive any ownership rights or intellectual property rights in the report. Upon receipt of this report, Customer accepts the report and agrees to pay the amount specified.